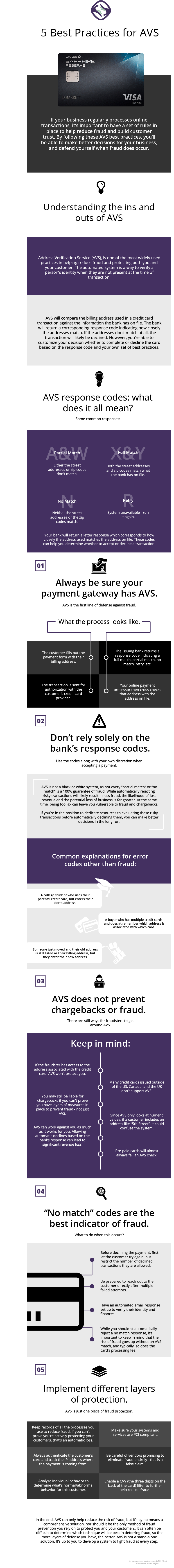

5 Best Practices for AVS

How AVS (Address Verification Service) is one important piece of fraud protection.

No matter what industry you’re in, if your business regularly processes online transactions, AVS is an important piece of keeping you and your customers safe from fraud.

AVS is a widely used method of fraud protection. The automated system helps to verify a person’s identity when they’re not present at the time of transaction.

Learn how to make AVS work for you with these 5 best practices:

1. Always be sure your payment gateway has AVS – AVS is the first line of defense against fraud.

2. Don’t rely solely on the bank’s response codes – Use the codes along with your own discretion.

3. AVS does not prevent fraud – There are still ways for fraudsters to get around AVS.

4. “No match” codes are the best indicator of fraud – Know what steps to take when this occurs.

5. Implement different layers of protection – AVS is just one piece of fraud protection.

Read the full post below!

Are you looking for a solution that can streamline the process of getting third party credit card authorizations safely and securely?

Sertifi eAuthorizations can help prove if a potential customer is legitimate, and can help defend against fraud. Sertifi helps our clients minimize the risk of fraud with AVS and CVV checks.

“Sertifi eAuthorizations logs everything. It can track what time they signed it. It can track what IP address their devise was on. So, it has those breadcrumbs to trace it back to the signer. And if they did not really authorize it then eAuthorizations can help prove that. Without eAuthorizations it’s hard to prove anything.” – Raymond Manaois, CTO at Hotel Development & Management Group

Want to learn more about how Sertifi can help you with fraud? Contact us today!